Written By: Dan North | Jan 5, 2019 12:00:00 AM

By Dan North, North America Chief Economist via TMSA Affiliate Member Euler Hermes North America

GDP growth, expected to be 2.9% for the year, tied 2015 for the strongest of the nine year recovery. Recent growth was particularly impressive in Q2 at 4.2% q/q annualized and 3.5% in Q3. The all-important consumer sector flexed its muscles at 3.8% and 3.6% in Q2 and Q3. Manufacturing was strong. Wages grew at the fastest in nine years. Job creation was vigorous. Inflation and interest rates remained low, and corporate profits set records. It was as good as it’s going to get.

In other words, it’s not going to get any better. While we expect the economy to remain vibrant for the next few quarters, it is starting to show signs of frailty which give us concern towards the end of 2019 and into the beginning of 2020. GDP will likely grow over 2% for all of 2019, but the going could get rough, primarily because fiscal stimulus will be drying up, and the Federal Reserve has been tightening monetary policy. When the Fed tightens, it is trying to fend off inflation and keep the economy from growing too fast, and it always works.

Current conditions have laid a smooth path for growth into the beginning of the year. Perhaps most importantly, the consumer appears to be in a strong position to fuel the economy. Growth in real disposable income is currently running at 2.8% y/y vs the recovery average of 2.4%, providing the ability to spend. Wage growth recently reached 3.1% y/y, the highest in nine years. Consumers have a low debt burden, and confidence is hovering near an 18 year high, providing the willingness to spend. The combination of growing income, low debt, and high confidence strongly suggest that solid spending will continue through most of 2019.

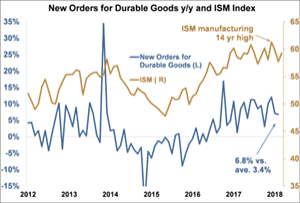

Business confidence as measured by the National Federation of Independent Business (NFIB) Small Business Optimism Index remains near record highs, as does the net percentage of respondents in the survey saying now is a good time to expand business. The manufacturing sector still has plenty of momentum to carry it into the New Year. The ISM manufacturing index recently reached a 14 year high. New orders for durable goods are growing at 6.8% y/y, twice the long-term average of 3.4%. On the services side, the ISM non-manufacturing index is hovering near a 13 year high.

Source: IHS, ISM, Census, Euler Hermes

The labor market remains very strong with no letup in sight. Job creation has actually accelerated this year, from 1.5% y/y last November to 1.7% currently, something you wouldn’t expect this late in the cycle, and indeed the labor force has grown by 2.2 million people in the past 12 months. More importantly, demand for labor is terrific as there are now 7 million job openings, compared to 6 million unemployed persons, a ratio of 1.2 suggesting that job creation will extend well into 2019.

There has even been progress on the trade front as the new US-Mexico-Canada (USMCA) trade agreement has been negotiated and symbolically signed (although it could face some tough going in Congress). And trade negotiations with China, as bumpy as they are, have shown some progress, although we still have a very long way to go.

Finally, inflation and interest rates are expected to remain low, productivity has grown for three straight quarters, and corporate profits after the tax cuts are growing at 19% y/y vs. the long-term average of around 8%. Things look good for the next few quarters.

As we try to look into the future, there are some specks on the horizon that are causing us to squint our eyes, strain to look out in the distance, and swallow just a little bit hard. What is that coming our way?

Uncertainty will weigh heavily on the economy in the next year. We will have a divided government where very little will get done legislatively, with the possible exceptions of infrastructure spending and drug pricing. President Trump will take to governing by issuing Executive Orders that will be immediately challenged. Trump will also come under intense scrutiny, and could actually suffer impeachment, although he is quite unlikely to be removed from office. The nation will not enjoy this arrangement and social division is likely to increase.

Another source of uncertainty is the ongoing trade dispute with China. Tariffs have clearly had a negative effect on the US economy, particularly on agriculture. Business leaders are openly worried about tariffs as heard on earnings calls, and as seen in quotes from participants in the two ISM surveys. Respondents to the Fed’s November Beige Book survey mentioned tariff concerns 39 times. And while the USMCA has been agreed upon, tariffs on steel and aluminum remain in place, putting significant cost pressures on metals users. GM estimates that it has lost $1B in last year due to the metals tariffs. Harley Davidson has suggested that tariffs on metals plus retaliatory tariffs will cause them to take jobs overseas, the opposite of what is intended

The housing market, which never fully recovered from its collapse in 2005, now appears to be in trouble again. Prices are too high relative to incomes, and mortgage rates are up on the year. As a result, leading indicators such as starts, permits, inventories, and the National Association of Homebuilders (NAHB) index are all in decline.

There are several indictors that suggest that we are in the late stages of the economic expansion. For instance, the details of the Conference Board’s Consumer Confidence survey are disturbing. The difference between consumers’ assessments of the present situation and the future outlook has gapped wide open, and this condition is often seen before a recession. Another indicator suggesting a coming downturn is the relationship between the unemployment rate and the “natural rate” of unemployment. When the current unemployment rate drops below the natural rate, as it has now, it suggests a state of unsustainable growth, and rising inflationary pressures which will damage the economy. It also happens to coincide frequently with Fed tightening.

Trouble is brewing in the credit markets as corporate debt as a percent of GDP has hit a new record, a strong warning sign. Credit spreads are opening rapidly on high yield bonds, and of course government debt is set to continue growing into the foreseeable future. In addition, that increase in debt is partially due to the fiscal stimulus of tax cuts and spending increases, and unfortunately that stimulus will be drying up towards the end of 2019, providing yet another significant drag on economic growth.

Source: IHS, Federal Reserve, BEA, Euler Hermes

However, the most significant risk to the economy is that the Federal Reserve has been tightening monetary policy, which will surely slow the economy. The Fed is charged with balancing inflation and unemployment, and when it is raising rates as it is doing now, it senses that unemployment is too low (at a 45 year low), inflationary pressures are building (wages at a nine year high), and the economy must be cooled off. So after an extraordinary seven year period of 0% interest rates and quantitative easing, the Fed started to raise interest rates very slowly at the end of 2015 and has now arrived at a range of 2.25%-2.5%. The problem is, this approach of raising interest rates to fend off inflation and slow the economy usually works so well, that the Fed drives the economy into a recession. When the Fed pushes short-term rates higher than long-term rates and inverts the yield curve, a recession almost always follows, and the Fed is perilously close to having done just that. In fact, December’s Fed meeting was viewed by financial markets as not being dovish enough, and the curve from 1-5 years essentially became flat. This is unequivocally a bad sign. If the curve between the 10 year and the 3 month becomes inverted (that is the spread between the 10 year and the 3 month becomes negative), even for just a few weeks, a recession is almost certain to follow in three to five quarters.

Economic conditions at the moment are setting a fine stage for continued growth through most of 2019. The consumer has increasing wages and confidence. Small business remains optimistic. Manufacturing new orders and a strong ISM index suggest more activity to come. Demand for labor is frantic, progress is being made on the trade front, and interest rates and inflation are likely to remain low. It’s a good setup for now.

But things on the horizon, towards the end of the year, are worrisome. A divided government and an unpredictable President will provide continued uncertainty. The trade picture is also uncertain and clearly tariffs are already taking a toll. The housing market is decaying. The shortage of skilled labor economy-wide is suppressing growth, and some indicators are strongly suggesting that we are late in the economic cycle. And the Federal Reserve has almost inverted the yield curve, an ominous sign of an economic downturn coming in the next three to five quarters.

What could change this outlook? First, the Fed could start signaling a much more dovish approach, perhaps including a suggestion of a pause in rate hikes. The yield curve could start to steepen again. Corporations could start paying down debt. The trade dispute with China could get resolved, the metals tariffs could get removed, and bipartisan government cooperation could emerge. All of these things are possible. But we ought to prepare for the less happy scenario.

Tags:

By Brian Everett, ABC, Chief Executive Officer, Transportation Marketing & Sales Association As I have conversations with TMSA members and learn about their challenges and opportunities, it...