Written By: TMSA Staff | Jun 20, 2019 12:00:00 AM

Sales strategy and operations are becoming more sophisticated among companies in the transportation and logistics industry. At least that’s the findings from the 2019 TMSA Marketing & Sales Metrics Study.

This year marks TMSA’s fourth annual sales and marketing metrics study. The Transportation Intermediaries Association (TIA), the Intermodal Association of North America (IANA), and Transport Topics magazine promoted participation in this study. At the 2019 TMSA Logistics Marketing & Sales Conference last week, TMSA’s CEO Brian Everett made the observation that many companies are looking more holistically at their sales strategy and operations.

“Transportation and logistics organizations are more aggressively tying sales goals and objectives to overall business strategy, and deploying their sales organizations based upon business goals, objectives and strategy,” Everett said. “They’re also setting up their sales teams for success with more tools and support in technology, training and measurement.”

The goal of TMSA’s metrics study is to help sales and marketing practitioners and business leaders gain a better understanding of key sales and marketing metrics, how the metrics change over time, and best practices for marketing and sales success.

The survey instrument was a confidential, Web-based survey consisting of 16 demographic questions, 20 sales questions, and 20 marketing questions. The 2019 study received the support of more than 150 respondents, with 36.8% in corporate management, 36.2% in sales leadership, and 20.4% in sales operations. Nearly 65% of respondents represent third-party logistics companies (including truck brokers, IMCs and freight forwarders), and 32.9% representing over-the-road motor carriers. The remainder include technology innovators (16%), parcel/last mile providers (8%), maritime players (5.8%), manufacturers (3%), and rail carriers (2.2%). Of all respondents, a majority (54%) are small- and mid-sized companies with work forces under 500. An additional 19% are medium-sized companies with 500-999 employees; and 27% large enterprises with more than 1,000 employees.

Leveraging Technology Tools to Generate More Sales Results

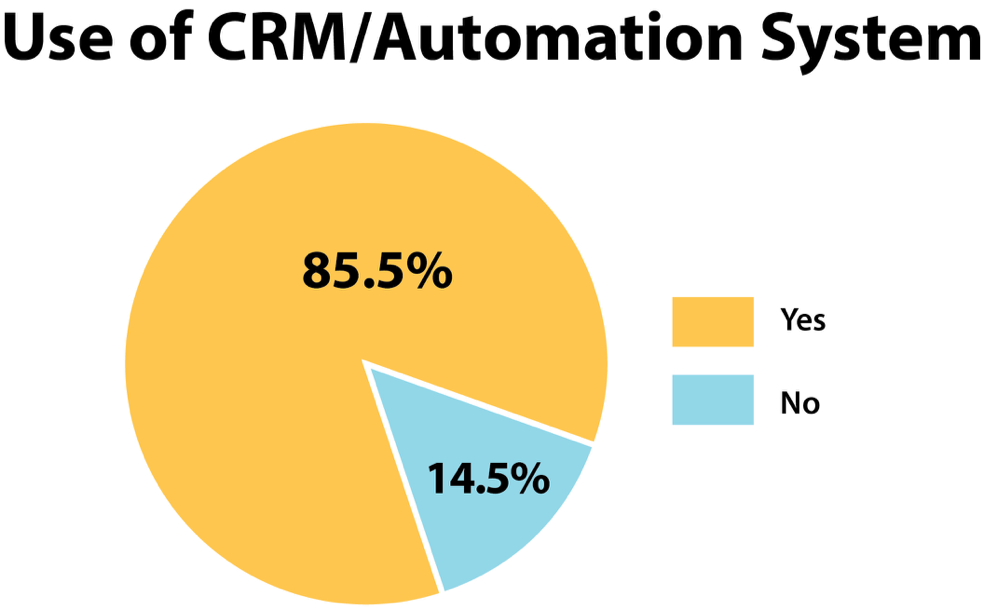

Everett noted that the metrics study has seen an increase in the use of Customer Relationship Management (CRM) and Sales Automation Systems. In fact, 87.3% respondents in this year’s study say they currently have such systems in place. That said, the use of CRM systems is fragmented in this industry, with SalesForce being the leading CRM system used (35.2%), but followed by 32% saying “other” systems. Nearly 10.5% say they use Microsoft Dynamics, and surprisingly, 11.2% say they still manage their own home-grown, proprietary system. “We’re also seeing an emergence of CRM systems specifically focused on the transportation industry, such as Winmore, PipelineDeals and SalesDrip,” said Everett.

Qualified Lead Gen: The Magic Bullet in Sales Success

Companies operating in the transportation and logistics industry are becoming more strategic and sophisticated in their lead generation. This is partially driven by the ongoing widespread use of the Internet and web-based technologies, SEO, and emerging digital technologies including artificial intelligence (AI), according to Everett. He points to key indicators in the 2019 TMSA Marketing & Sales Metrics Study that underscore how such developments are enhancing lead generation practices.

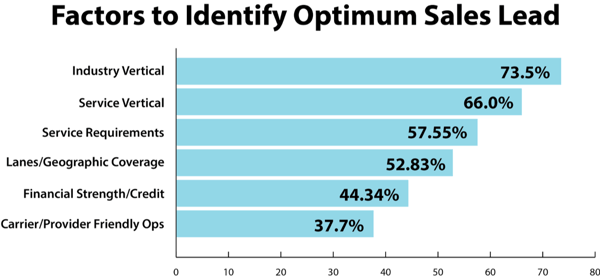

With the use of more sophisticated technology tools and the ability to segment targets within the market, savvy sales and marketing leaders are able to more effectively qualify leads. In fact, they’re honing in on key identifying characteristics that make the optimum sales lead for their companies.

In the 2019 TMSA metrics study, 73.1% say they’re focused on industry verticals to identify the ideal sales lead; another 64.1% say service verticals (i.e., dry van, refrigerated, intermodal, flatbed, etc.) are important. Approximately 55% say service requirements (i.e., delivery and transit times) are critical, and 50.8% say lanes and geographic coverage requirements are important.

The 2019 TMSA Marketing & Sales Metrics Study will be available to all TMSA members at no cost by the end of July.

Tags: Strategy

By Brynn Everett, Marketing & Communications Project Manager, MindShare Strategies With today’s fragmented communication and marketing channels, and complete control resting in the hands of the...