Written By: Jason Ickert | Dec 13, 2018 12:00:00 AM

By Jason Ickert, a seasoned commercial leader in the 3PL space with more than 23 years’ experience in various sales and marketing roles. Jason is currently a team member at ENERGY Transportation Group where he is engaged in their initiative to integrate logistics processes with technology. Ickert also sits on the TMSA Board of Directors and is co-chair of the Membership Committee.

What happened to peak season? The demand we were expecting, considering the booming consumer economy, was a bit disappointing. Was it because of the increase and threat of additional tariffs that caused importers to forward stock their inventory earlier? Or perhaps because of the increase in e-commerce, and less brick-and-mortar foot traffic, retailers have held off allocating large quantities forward to store DC's and are filling customer orders direct from import warehouses?

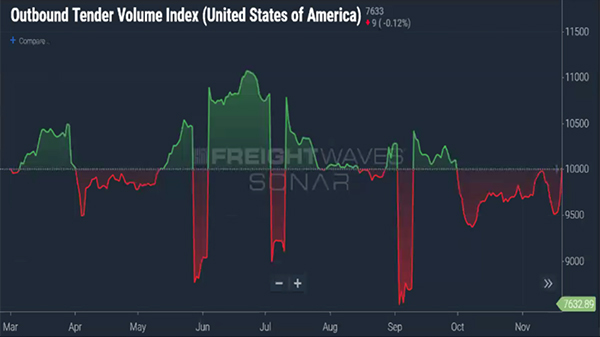

Looking at the data, we are certainly seeing signs that the truckload market is entering a cooler period, and capacity is freeing up. FreightWaves, the leading go to source for information about the freight markets, measured the current outbound tender rejection index at about 9,726, on a basis if 10,000 set in March 2018. This is down from a high of 11,080 in late June of this year.

More carriers are accepting loads at contract rates on the first tender, a sign that capacity has returned to the market.

(source: FreightWaves)

Another chart from Chainalytics looked at around 40 top tier shippers with an annual truckload spend of about $10B and found that less demand, and increased capacity had caused a steep decline in truckload spot rate premiums, that we thought were going to be the new normal.

For shippers, this means that there is greater supply and less demand. Expect freight rates to fall.

(source: Chainalytics)

How is this possible? Shippers have been told for months by carriers, 3PLs and freight brokers alike that rates would continue to increase all the way through 2019. Turns out, in times of volatility and uncertainty, especially the largest asset based carriers, are able to publicize a narrative that leverages their capacity and allows for them to realize higher margins…on paper.

Unfortunately for them, 97% of the market is driven by carriers with less than 20 power units, and these guys are running lifestyle businesses that demand, in order to maintain cash flow, that they keep the wheels turning. This means that they are going to compete for loads, especially in the brokerage markets where the separation of spot rates from contract levels spells lower costs for shippers who lay off more of their loads onto the spot market as this chart from DAT shows. (source: DAT Solutions LLC)

To mitigate their exposure to the capacity crunch, many shippers have already begun, and perhaps have already signed their 2019 rate agreements. On average, most accepted a 5% increase to ensure service. Most market professionals are calling for that to rationalize at about <3% as shippers go back out to market or begin to claw back the increases they took.

Tags: